Our approach to investing

The thinking behind the investment strategy

Our aims: Our aim is to invest the RWE Group’s assets to ensure that we have enough funds to pay members’ pensions. In the past, the focus was more on growing the assets to achieve this aim. But now, as the amount of assets we hold has increased, the focus is more on protecting what the RWE Group has.

Our approach to risk: We can invest the assets in a relatively low-risk way and still expect to pay out all pensions that are due. The portfolio is therefore now more balanced towards investing in lower risk bonds rather than riskier investments such as stocks.

Our time horizon: The Group Trustees have a long-term approach to investment. That means, when deciding whether to buy, keep, or remove an investment, we think about how it could perform over the next 5-10 years, rather than how it might change in the short term.

Our strategy: We build a diversified investment portfolio (so we’re not putting all our eggs in one basket) that’s designed to generate income. This income helps us pay pensions as they become due, without needing to sell investments at a bad time (for example, when the stock market is down). Instead the investments naturally produce regular interest payments we can use to pay pensions.

Where do we invest?

You may have seen news last year about the UK Government encouraging pension schemes to invest more in UK businesses and projects. The Group Trustees’ approach has not changed in response to this and we will continue to follow our long-standing investment strategy.

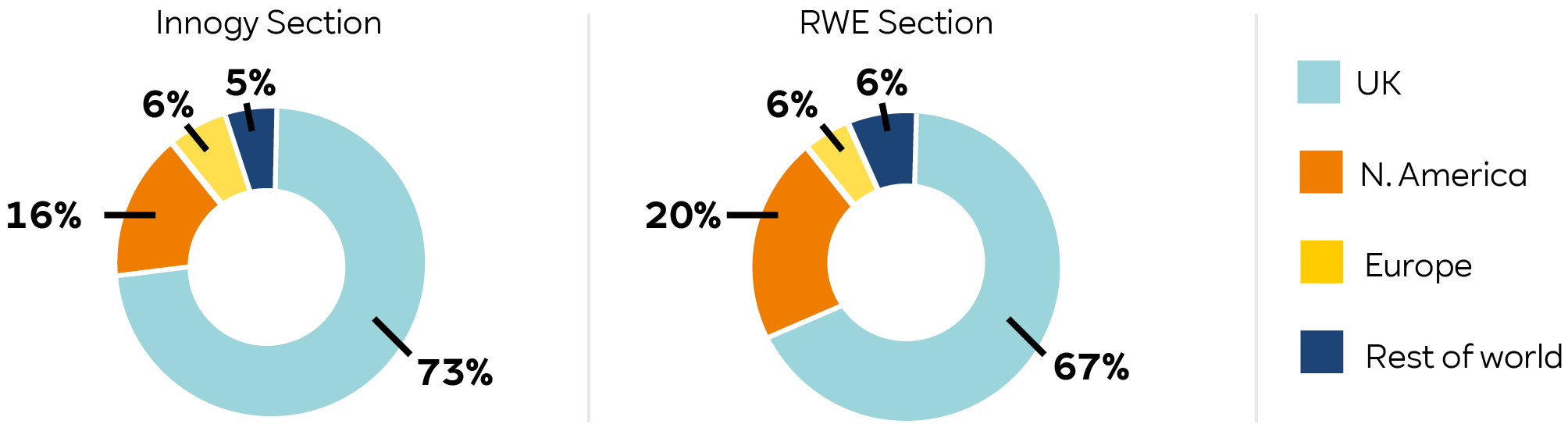

A material proportion of assets are invested in the UK, this reflects our strategy to align investments with UK inflation and match members’ benefits over time. The RWE Group also holds assets in overseas investments to spread risk across different markets and maintain a well-diversified portfolio. We carefully manage the impact of currency movements so that changes in the exchange rates do not significantly affect the overall value of the investments.

You can learn more by reading the Scheme's Statement of Investment Principles on LIFETRACK.

These charts summarise the geographical exposure of the portfolios for each Section as at 30 June 2025 (excluding cash)

Investing responsibly

The Group Trustees continue to believe that issues such as climate change, biodiversity loss and social factors (such as human rights issues) can have a material financial impact on the Group’s assets.

As a result, the Group Trustees monitor these issues closely, working with the Responsible Investment Committee to improve the Group’s portfolio over time, managing the risks posed by these issues and also looking to take advantage of any opportunities presented.

Over the year, there have been a number of developments:

Introducing a new portfolio of stocks: The Group Trustees made a new allocation to a stock index which considers the impact of the climate transition (i.e. moving to a low carbon economy) in its construction. This new investment allocates a greater proportion of assets to stocks that are expected to benefit from this transition and a lower proportion of assets to stocks that are at risk from the transition. The Group Trustees consider that this better manages the risks and opportunities associated with climate change.

Scenario analysis: Every three years, the Group Trustees consider how the funding of the Group could develop in a range of different positive and negative outcomes for climate change. This includes scenarios where there is a rapid and effective global transition to net zero and scenarios where the world fails to transition to net zero. Following this work, the Group Trustees concluded that, while climate change remains a material risk, the Group is well positioned for a range of potential outcomes due to its strong funding position and the nature of its investments.

Manager engagements: The Group Trustees work with a number of investment managers who invest the Group’s assets. Over the year, the Group Trustees engaged with their appointed managers to communicate the Group’s belief in the importance of climate change, biodiversity loss and social factors. Managers were asked to explain how they incorporated these issues into their investment decisions. Overall, the Group Trustees were pleased with the responses they received but will continue to work with the managers to ensure this remains the case.

Want more detail?

Similar to last year, the Group Trustees have produced a report which details how they are managing the risks and opportunities associated with climate change. This includes both a standalone report from the Group as well as a contribution to the wider Electricity Supply Pension Scheme (ESPS) report. While the reports are quite technical, as required by the regulations, there is a foreword by the Chair of the Group Trustees and an executive summary, which provide an overview of how the work done by the Group Trustees supports the security of your benefits.

You can find the find the full reports published at the links below, and we look forward to keeping you updated on our progress in future years.

LIFETRACK

LIFETRACK